SCHEDULE 14A(RULE 14A-101)INFORMATION REQUIRED IN PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATIONPROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIESEXCHANGE ACT OF

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (AMENDMENT NO.

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting |

AMERICREDIT CORP.

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing feeFiling Fee (Check the appropriate box):

| No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ |

| (1) | Amount |

| (2) | Form, |

| (3) | Filing |

| (4) | Date |

Notes:

![]()

801 Cherry Street, Suite 3900

Fort Worth, Texas 76102

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Dear AmeriCredit Shareholder:

On Tuesday,Wednesday, November 6, 2001,3, 2004, AmeriCredit Corp. will hold its 20012004 Annual Meeting of Shareholders at the Fort Worth Club, 306 West Seventh Street, Fort Worth, Texas. The meeting will begin at 10:00 a.m.

Only shareholders who owned stock at the close of business on Thursday,Tuesday, September 20, 20017, 2004 can vote at this meeting or any adjournments that may take place. At the meeting we will:

| 1. | Elect three members of the Board of Directors |

| 2. | Consider and vote upon |

| 3. | Consider and vote upon |

| 4. | Consider and vote upon a proposal to approve the Senior Executive Bonus Plan; |

| Ratify the appointment by AmeriCredit’s Audit Committee of |

| 6. | Attend to other business properly presented at the meeting. |

Your Board of Directors recommends that you vote in favor of the proposals outlined in the Proxy Statement.

At the meeting, we will also report on AmeriCredit'sAmeriCredit’s fiscal 20012004 business results and other matters of interest to shareholders.

The approximate date of mailing for the Proxy Statement, proxy card and AmeriCredit's 2001AmeriCredit’s 2004 Annual Report is September 26, 2001.27, 2004.

We hope you can attend the Annual Meeting. Whether or not you can attend, pleasereadthe enclosed Proxy Statement. When you have done so, pleasemarkyour votes on the enclosed proxy card,sign and datethe proxy card, andreturnit to us in the enclosed envelope. Your vote is important, so please return your proxy card promptly.

Sincerely, |

Chris A. Choate Secretary |

September 24, 2004

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 6, 20013, 2004

SOLICITATION AND REVOCABILITY OF PROXIES

The accompanying proxy is solicited by the Board of Directors on behalf of AmeriCredit Corp., a Texas corporation ("AmeriCredit"(“AmeriCredit” or the "Company"“Company”), to be voted at the 20012004 Annual Meeting of Shareholders of AmeriCredit (the "Annual Meeting"“Annual Meeting”) to be held on November 6, 2001,3, 2004 at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders (the "Notice"“Notice”) and at any adjournment(s) thereof.When proxies in the accompanying form are properly executed and received, the shares represented thereby will be voted at the Annual Meeting in accordance with the directions noted thereon; if no direction is indicated such shares will be voted for the election of directors and in favor of the other proposals set forth in the Notice.

The principal executive offices of AmeriCredit are located at 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102. AmeriCredit'sAmeriCredit’s mailing address is the same as its principal executive offices.

This Proxy Statement and accompanying proxy card are being mailed on or about September 26, 2001. AmeriCredit's27, 2004. AmeriCredit’s Annual Report on Form 10-K covering the Company'sCompany’s fiscal year ended June 30, 20012004 is enclosed herewith, but does not form any part of the materials for solicitation of proxies.

The enclosed proxy, even though executed and returned, may be revoked at any time prior to the voting of the proxy by giving written notice of revocation to the Secretary of the Company at the Company'sCompany’s principal executive offices or by executing and delivering a later-dated proxy or by attending the Annual Meeting and voting in person. However, no such revocation shall be effective until such notice has been received by the Company at or before the Annual Meeting. Such revocation will not affect a vote on any matters taken prior to receipt of such revocation. Mere attendance at the Annual Meeting will not of itself revoke the proxy.

In addition to the solicitation of proxies by use of the mail, the directors, officers and regular employees of the Company may solicit the return of proxies either by mail, telephone, telegraph, or through personal contact. Such officers and employees will not be additionally compensated but will be reimbursed for out-of-pocket expenses. AmeriCredit has also retained Georgeson Shareholder Communications, Inc. ("GSC"(“GSC”) to assist in the solicitation of proxies from shareholders and will pay GSC a fee of approximately $8,000$7,500 for its services and will reimburse such firm for its out-of-pocket expenses. Brokerage houses and other custodians, nominees, and fiduciaries will be requested to forward solicitation materials to the beneficial owners. The cost of preparing, printing, assembling and mailing the Annual Report, the Notice, this Proxy Statement and the enclosed proxy, as well as the cost of forwarding solicitation materials to the beneficial owners of shares and other costs of solicitation, will be borne by AmeriCredit.

Some banks, brokers and other record holders have begun the practice of “householding” proxy statements and annual reports. “Householding” is the term used to describe the practice of delivering a single set of the proxy statement and annual report to any household at which two or more shareholders reside if a company reasonably believes the shareholders are members of the same family. This procedure would reduce the volume of duplicate information shareholders receive and would also reduce the Company’s printing and mailing costs. The Company will promptly deliver an additional copy of either document to any shareholder who writes or calls the Company at the following address or phone number: Investor Relations, AmeriCredit Corp., 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102, (817) 302-7000.

PURPOSES OF THE MEETING

At the Annual Meeting, the shareholders of AmeriCredit will consider and vote on the following matters:

| 1. | The election of three |

| 2. |

| 3. | The proposal to amend the Amended and Restated 2000 Limited Omnibus and Incentive Plan for AmeriCredit Corp. (the “2000 Plan”); |

| 4. | The proposal to approve the Senior Executive Bonus Plan (the “Bonus Plan”); |

| 5. | The ratification of the appointment by the |

| The transaction of such other business that may properly come before the Annual Meeting or any adjournments thereof. |

QUORUM AND VOTING

The record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting was the close of business on September 20, 20017, 2004 (the "Record Date"“Record Date”). On the Record Date, there were 84,339,085155,350,631 shares of Common Stock of the Company, par value $0.01 per share, outstanding, each of which is entitled to one vote on all matters to be acted upon at the Annual Meeting. There are no cumulative voting rights. The presence, in person or by proxy, of holders of a majority of the outstanding shares of Common Stock entitled to vote at the meeting is necessary to constitute a quorum to transact business. Assuming the presence of a quorum, the affirmative vote of the holders of a plurality of the shares of Common Stock represented at the Annual Meeting is required for the election of directors, and the affirmative vote of the holders of a majority of the shares of Common Stock represented at the Annual Meeting is required for the approval of the amendmentamendments to the Purchase1998 Plan and forthe 2000 Plan, approval of the Bonus Plan and the ratification of the appointment by the Board of Directors of PricewaterhouseCoopers LLP as independent public accountants for the Company for the fiscal year ending June 30, 2002. Approval of the amendment to the Company's Articles of Incorporation to increase the authorized number of shares of Common Stock from 120,000,000 to 230,000,000 requires the affirmative vote of at least two-thirds of the outstanding shares entitled to vote.2005.

Abstentions and broker non-votes are counted towards determining whether a quorum is present. Broker non-votes will not be counted in determining the number of shares voted for or against the proposed matters, and therefore will not affect the outcome of the vote except that a broker non-vote will have the same effect as a "no" vote on the proposed amendment to the Articles of Incorporation since adoption of such amendment requires at least two-thirds of the outstanding shares entitled to vote. Abstentions on a particular item (other than the election of directors) will be counted as present and voting for purposes of anythe item on which the abstention is noted, thus havingbut will have the effect of a "no"“no” vote as to that proposal because each proposal (other than the election of directors) requires the affirmative vote of a majority of the shares voting at the meeting. With regard to the election of directors, votes may be cast in favor of or withheld from each nominee; votes that are withheld will be excluded entirely from the vote and will have no effect.

2

PRINCIPAL SHAREHOLDERS AND STOCK OWNERSHIP OF MANAGEMENT

The following table and the notes thereto set forth certain information regarding the beneficial ownership of the Company's Common StockCompany’s common stock as of the Record Date, by (i)(1) each current director and nominee for director of the Company; (ii)(2) each Named Executive Officer (as defined in the "Executive Compensation-Summary Compensation Table" on page 8Officer; (3) all of this Proxy Statement); (iii) allour present executive officers and directors of the Company as a group; and (iv)(4) each other person known to the Companyus to own beneficially more than five percent of theour presently outstanding Common Stock.common stock. Unless otherwise indicated, the address for the following shareholders is 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102.

| Common Stock Owned Beneficially (1) | Percent of Class Owned Beneficially (1) | |||||

|---|---|---|---|---|---|---|

| Liberty Wanger Asset Management, L.P. | 5,916,900 | (2) | 7.02% | |||

| Clifton H. Morris, Jr | 2,349,610 | (3) | 2.74% | |||

| Michael R. Barrington | 1,061,746 | (4) | 1.24% | |||

| Daniel E. Berce | 1,657,865 | (5) | 1.93% | |||

| Edward H. Esstman | 875,426 | (6) | 1.03% | |||

| A. R. Dike | 115,000 | (7) | * | |||

| James H. Greer | 528,908 | (8) | * | |||

| Douglas K. Higgins | 266,000 | (9) | * | |||

| Kenneth H. Jones, Jr | 215,000 | (10) | * | |||

| Michael T. Miller | 130,316 | (11) | * | |||

| All Present Executive Officers and Directors as a Group | ||||||

| (16 Persons) (3)(4)(5)(6)(7)(8)(9)(10)(11) | 7,702,599 | 8.55% | ||||

*

| Common Stock Owned Beneficially (1) | Percent of Class Owned Beneficially (1) | |||||

Legg Mason Capital Management, Inc. | 15,000,000 | (2) | 9.66 | % | ||

PIMCO Equity Advisors | 9,796,000 | (3) | 6.31 | % | ||

Columbia Wanger Asset Management, L.P. | 9,313,700 | (4) | 6.00 | % | ||

Capital Guardian Trust Company | 8,887,000 | (5) | 5.72 | % | ||

Eubel Brady & Suttman Asset Management, Inc. | 8,154,000 | (6) | 5.25 | % | ||

Clifton H. Morris, Jr. | 3,149,847 | (7) | 2.00 | % | ||

Daniel E. Berce | 2,277,516 | (8) | 1.45 | % | ||

Michael R. Barrington | 100,932 | (9) | * | |||

John R. Clay | 20,000 | (10) | * | |||

A.R. Dike | 164,300 | (11) | * | |||

James H. Greer | 318,300 | (12) | * | |||

Douglas K. Higgins | 360,000 | (13) | * | |||

Kenneth H. Jones, Jr. | 250,000 | (14) | * | |||

B.J. McCombs | 21,000 | (15) | * | |||

Mark Floyd | 235,579 | (16) | * | |||

Preston A. Miller | 375,938 | (17) | * | |||

Chris A. Choate | 313,096 | (18) | * | |||

All Present Executive Officers and Directors as a Group (13 Persons) | 7,821,834 | 4.86 | % |

| * | Less than 1% |

| (1) | Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to the shares of our Common Stock shown as beneficially owned by them. Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as |

| (2) | Pursuant to a Form 13F filed on or about June 30, 2004, Legg Mason Capital Management, Inc. reports holding an aggregate of 15,000,000 shares. The address of Legg Mason Capital Management, Inc. is 100 Light Street, Baltimore, Maryland 21202. |

| (3) |

| (4) | Columbia Wanger Asset Management, L.P. reports holding an aggregate of |

3

| Pursuant to a Form 13F filed on or about June 30, 2004, Capital Guardian Trust Company reports holding an aggregate of 8,887,000 shares. The address of Capital Guardian Trust Company is 333 South Hope Street, 55thFloor, Los Angeles, California 90071. |

| (6) | Pursuant to a Form 13F filed on or about June 30, 2004, Eubel Brady & Suttman Asset Management, Inc. reports holding an aggregate of 8,154,000. The address of Eubel Brady & Suttman Asset Management, Inc. is 7777 Washington Village Drive, Dayton, Ohio 45459. |

| (7) | This amount includes |

| (8) | This amount includes |

| (9) | This amount includes |

| (10) | This amount includes |

| The amount includes |

| (12) | This amount includes |

| (13) | This amount includes |

| (14) | This amount includes 180,000 shares subject to stock options that are currently exercisable or exercisable within 60 days. |

| (15) | This amount includes |

| (16) | This amount includes 194,180 shares subject to stock options that are currently exercisable or exercisable within 60 days. |

| (17) | This amount includes 288,820 shares subject to stock options that are currently exercisable or exercisable within 60 days. |

| (18) | This amount includes 222,420 shares subject to stock options that are currently exercisable or exercisable within 60 days. |

4

ELECTION OF DIRECTORS

(Item 1)

On September 7, 1999, the Board of Directors adopted amendments to the Company'sCompany’s bylaws classifying the Board of Directors into three (3) classes, as nearly equal in number as possible, each of whom would serve for three years, with one class being elected each year. The Board of Directors believes that the staggered three-year term of the classified Board of Directors helps assure the continuity and stability of management of the Company. This continuity and stability will result from the fact that with the classified Board of Directors, the majority of the directors at any given time will have prior experience as directors of the Company. The classified Board of Directors is also intended to protect shareholders'shareholders’ rights in the event of an acquisition of control by an outsider which does not have the support of the Board of Directors.

The Board of Directors has set the number of directors for the ensuing year at eight (8). At the 2001 Annual Meeting, three (3) Class II directors shall be elected to serve terms expiring at the

On August 26, 2004, Annual Meeting. All three (3) nominees are currently membersMr. Gerald J. Ford resigned as a director of the Board of Directors.

Vacancies occurring on the Board may be filled byCompany. Mr. Edward H. Esstman retired from the Board of Directors for the unexpired term of the replacement director's predecessorCompany effective August 31, 2004. Additionally, Mr. Michael R. Barrington announced his intention not to stand for re-election to the Board of Directors on August 31, 2004. Mr. Barrington’s service as a director will end on November 3, 2004.

As a result of Mr. Ford’s resignation, Mr. Esstman’s retirement and Mr. Barrington’s decision not to stand for re-election, the Board of Directors on September 14, 2004, upon recommendations from the Nominating and Corporate Governance Committee, re-classified the board membership structure in office. order to equalize the membership size of the three classes in accordance with listing requirements of the New York Stock Exchange. Mr. A.R. Dike, who was elected as a Class III director in 2002 (term expiring in 2005), was recommended as a nominee for director to stand for election this year as a Class II director (term expiring in 2007).

In order to be elected, each nominee for director must receive at least the number of votes equal to the plurality of the shares represented at the meeting, either in person or by proxy. Unless otherwise directed in the enclosed proxy, it is the intention of the persons named in such proxy to vote the shares represented by such proxy for the election of the following named nominees to the Board of Directors.

Vacancies occurring on the Board may be filled by the Board of Directors upon recommendations of the Nominating and Corporate Governance Committee for the unexpired term of the replacement director’s predecessor in office.

The Board of Directors has selected the following nominees recommended by the Nominating and Corporate Governance Committee for election to the Board of Directors:

CLASS II — NOMINEES FOR TERMS EXPIRING IN 2004:2007:

MICHAEL R. BARRINGTONA.R. DIKE,, 42,68, has been a director since 1990.1998. Mr. Barrington has been Vice Chairman,Dike is the President and Chief Executive Officer of The Dike Company, Inc., a private insurance agency, and Presidenthas been in such position since July 2000.1999. Prior to July 1999, Mr. BarringtonDike was President of Willis Corroon Life, Inc. of Texas, and was in such position for more than five years. Mr. Dike previously served as Vice Chairman, Presidenta director for several insurance companies. Mr. Dike served as a director of JPMorgan Chase Bank of Tarrant County and Chief Operating Officerits predecessor banks from November 1996 until July 20001977 though 1988 and was Executive Vice President and Chief Operating Officer from November 1994 until November 1996.currently serves as an advisory director. Mr. Dike is also a director of Cash America International, Inc., a publicly held pawn brokerage company.

DOUGLAS K. HIGGINS, 51,54, has been a director since 1996. Mr. Higgins is a private investor and owner of Higgins & Associates and has been in such position since July 1994. Mr. Higgins served as the President and Chief Executive Officer of H&M Food Systems Company, Inc. from 1983 through 1994. Mr. Higgins is also a director of Worth Bancorporation, a multi-branch bank operating in Tarrant County, Texas.

5

KENNETH H. JONES, JR., 66,69, has been a director since 1988. Mr. Jones, a private investor, retired as Vice Chairman of KBK Capital Corporation ("KBK"(“KBK”) (now known as Marquette Commercial Finance, Inc.), a publicly held non-bank commercial finance company, in December 1999. Mr. Jones had been Vice Chairman of KBK since January 1995. Prior to January 1995, Mr. Jones was a shareholder in the Decker, Jones, McMackin, McClane, Hall & Bates, P.C. law firm in Fort Worth, Texas, and was with such firm and its predecessor or otherwise involved in the private practice of law in Fort Worth, Texas for more than five years.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR"“FOR” THE ELECTION OF EACH OF THE INDIVIDUALS NOMINATED FOR ELECTION AS A DIRECTOR.

CONTINUING DIRECTORS:DIRECTORS — CLASS III — Terms Expiring in 2005:

CLIFTON H. MORRIS, JR., 66,69, has been a director since 1988. Mr. Morris has been Executive Chairman of the Board since July 2000May 1988 and has also served as Chief Executive Officer since April 2003. Mr. Morris served as Chairman of the Board and Chief Executive Officer from May 1988 to July 2000. Mr. Morris also served as President from May 1988 until April 1991 and from April 1992 to November 1996. Mr. Morris is also a director of Service Corporation International, a publicly held company that owns and operates funeral homes and related businesses,businesses.

JOHN R. CLAY, 56, has been a director since June 2003. Mr. Clay was Chief Executive Officer of Practitioners Publisher Company, Inc., a leading publisher of accounting and Cash America International,auditing manuals for CPA firms, from 1979 to 1999. Mr. Clay has also served 12 years as a publicly held pawn brokerage company.public accountant, in accounting first with Ernst & Ernst and later as a partner with Rylander, Clay & Opitz. Mr. Clay is a certified public accountant and has authored several accounting articles and financial publications.

B.J. McCOMBS, 76, has been a director since November 2003. Mr. McCombs is a private investor with interests in professional sports and other investments. Mr. McCombs serves as a director of Clear Channel Communication, Inc., a diversified media company that primarily operates in radio broadcasting, outdoor advertising and live entertainment, since its inception.

CONTINUING DIRECTORS — CLASS I — Terms Expiring in 2006:

DANIEL E. BERCE, 47,50, has been a director since 1990. Mr. Berce has been President since April 2003. Mr. Berce was Vice Chairman and Chief Financial Officer of the Company sincefrom November 1996 and wasuntil April 2003. Mr. Berce served as Executive Vice President, Chief Financial Officer and Treasurer for the Company from November 1994 until November 1996. Mr. Berce is also a director of INSpire Insurance Solutions, Inc., a publicly held company which provides policy and claims administration services to the property and casualty insurance industry, Curative Health Services, Inc., a publicly held company that provides specialty health care services, and AZZ incorporated, (formerly Aztec Manufacturing, Co.), a publicly held company that manufactures specialty electrical equipment and provides galvanizing services to the steel fabrication industry.

EDWARD H. ESSTMAN, 60, has been a director since 1996. Mr. Esstman has been Vice Chairman of the Company since August 2001. Mr. Esstman served as Executive Vice President, Dealer Services and co-Chief Operating Officer from October 2000 to August 2001, Executive Vice President, Dealer Services from October 1999 to October 2000, Executive Vice President, Auto Finance Division from November 1996 to October 1999 and Senior Vice President and Chief Credit Officer from November 1994 to November 1996.

A. R. DIKE, 65, has been a director since 1998. Mr. Dike is the President and Chief Executive Officer of The Dike Company, Inc., a private insurance agency, and has been in such position since July 1999. Prior to July 1999, Mr. Dike was President of Willis Corroon Life, Inc. of Texas, and was in such position for more than five years. Mr. Dike is also a director of Cash America International.

JAMES H. GREER, 74,77, has been a director since 1990. Mr. Greer is Chairman of the Board of Greer Capital Corporation as well as President of two companies involved in real estate and commercial real estate development and management. From 1985 to 2001, Mr. Greer served as Chairman of the Board of Shelton W. Greer Co., Inc., which engineers, manufactures, fabricates and installs building specialty products,products. Mr. Greer previously served as a director for several banks and has been such for more than five years.financial institutions. Mr. Greer is also a director of Service Corporation International.

6

Board Committees and Meetings

Standing committees of the Board include the Audit Committee, the Stock Option/Compensation Committee and the Nominating and Corporate Governance Committee.

The

Audit Committee'sCommittee

As enumerated more fully in its charter, the Audit Committee’s principal responsibilities consist of (i) recommending the selectionfollowing:

In accordance with SEC requirements, a copy of the Amended and Restated Charter of the Audit Committee is included as Appendix A to this Proxy Statement.

The Board has affirmatively determined that (i) all members of the Audit Committee are independent under the rules of the New York Stock Exchange and the Board’s Corporate Governance Guidelines, (ii) all members of the Audit Committee are financially literate, as the Board interpreted such qualifications in its business judgment and (iii) reviewingMr. Clay qualifies as an audit committee financial expert as defined in Item 401 of Regulation S-K under the Company's internal audit activitiesSecurities Exchange Act of 1934. Members consist of Messrs. Clay, Dike, Greer and matters concerningJones. In fiscal 2004, the Audit Committee met six times and, pursuant to the authority delegated to him by the Audit Committee, Mr. Jones, Chairman of the Committee, met with the Company’s independent auditors prior to the public release of the Company’s quarterly and annual financial reporting, accountingresults. The “Report of the Audit Committee” is contained in this Proxy Statement beginning on page 35.

Stock Option/Compensation Committee

As enumerated more fully in its charter, the Stock Option/Compensation Committee’s principal responsibilities consist of the following:

7

The Board has affirmatively determined that all members of the Stock Option/Compensation Committee are independent under the rules of the New York Stock Exchange and the Board’s Corporate Governance Guidelines. Members consist of Messrs. Greer, Higgins and Jones. Mr. Dike resigned from the Stock Option/Compensation Committee on August 6, 2004. In fiscal 2004, the Stock Option/Compensation Committee met four times. The “Report of the Stock Option/Compensation Committee on Executive Compensation” is contained in this Proxy Statement beginning on page 16.

Nominating and Corporate Governance Committee

As enumerated more fully in its charter, the Nominating and Corporate Governance Committee’s principal responsibilities consist of the following:

The Board has affirmatively determined that all members of the Nominating and Corporate Governance Committee are independent under the rules of the New York Stock Exchange and the Board’s Corporate Governance Guidelines. In fiscal 2004, the Nominating and Corporate Governance Committee met three times. Members consist of Messrs. Dike, Greer, Higgins and Jones. The "ReportMr. Higgins, as Chairman of this Committee, leads the executive sessions of the Audit Committee" is contained in this Proxy Statement beginning on page 19.independent directors held during every Board meeting.

The Stock Option/Compensation Committee (i) administers the Company's employee stock option and other stock-based compensation plans and oversees the granting of stock options and (ii) reviews and approves compensation for executive officers. Members consist of Messrs. Dike, Greer, Higgins and Jones.

The Nominating Committee was established in August 2001. The Nominating Committee (i) establishes procedures for the nomination of directors, (ii) recommends to the Board of Directors a slate of nominees for directors to be presented on behalf of the Board for election by shareholders at each Annual Meeting of the Company, (iii) recommends to the Board appropriate nominees to fill Board vacancies and (iv) considers nominees to the Board recommended by shareholders. Shareholders may nominate director nominees for consideration by writing to the Secretary of the Company at 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102 and providing the nominee's name, biographical data and qualifications. In order to be considered by the Nominating Committee, prospective nominee recommendations must be received by the Secretary no later than May 30th of the year in which the Annual Meeting is to be held. Members consist of Messrs. Dike, Greer, Higgins and Jones.

The Board of Directors held five regularly scheduled meetings during the fiscal year ended June 30, 2001.2004. Various matters were also approved during the last fiscal year by unanimous written consent of the Board of Directors. No director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board on which such director served.

Director Compensation

Members

For the fiscal year ended June 30, 2004, members of the Board of Directors currently receivereceived a $2,500 quarterly$24,000 annual retainer fee and an additionalas well as a $4,000 fee for attendance at each meeting of the Board. MembersBoard and members of Committeescommittees of the Board of Directors arewere paid $2,000$1,500 per quarter for participation in all committee meetings held during that quarter.meeting. Additionally, the Audit Committee Chairman

At

8

received a $4,000 annual retainer fee, and the 2000 Annual MeetingStock Option/Compensation Committee Chairman and Nominating and Corporate Governance Committee Chairman each received $3,000 annual retainer fees. During fiscal year 2004, no Board of Shareholders, the Company adopted the 2000 Limited Omnibus and Incentive Plan for AmeriCredit Corp. (the "2000 Plan"), which provides for grantsDirectors fees were paid to the Company's executive officers (other than Messrs. Morris, Barrington, Berce and Esstman) and to non-employee directors of stock options and reserves, inEsstman, the aggregate, a total of 2,000,000 shares of Common Stock for issuance upon exercise of stock options granted under such plan. Company’s employee directors.

On November 7, 2000,5, 2003, the date of the Company's 2000Company’s 2003 Annual Meeting of Shareholders, options to purchase 20,000 shares of Common Stock were granted under the Amended and Restated 2000 Limited Omnibus and Incentive Plan for AmeriCredit Corp. to each of Messrs. Clay, Dike, Ford, Greer, Higgins, Jones and JonesMcCombs at an exercise price of $28.44$13.55 per share. Theshare, an exercise price for the options granted to Messrs. Dike, Greer, Higgins and Jones is equal to the last reported sale price of the Common Stock on the New York Stock Exchange ("NYSE") on the day preceding the date of grant. These options, which have a term of ten years, are fully vested upon the date of grant, but may not be exercised prior to the expiration of six months after the date of grant.

The Board of Directors anticipates that an annual grant of stock options will be authorized under the 2000 Plan to non-employee directors following the 20012004 Annual Meeting of Shareholders in amounts and upon such terms as were authorized following the 20002003 Annual Meeting of Shareholders.

As part of their director compensation, each outside director is allowed to make personal use of the Company aircraft for a maximum of 30 flight hours per year. The out-of-pocket expense to the Company for the use of the Company aircraft by outside Board members during fiscal 2004 is a follows: $42,004 for Mr. Barrington; $10,597 for Mr. Dike; $18,370 for Mr. Higgins; and $31,818 for Mr. Jones. Messrs. Clay, Ford, Greer and McCombs did not use the Company aircraft in fiscal 2004.

Corporate Governance

The Board of Directors has adopted a Code of Business Conduct and Ethics to govern the conduct of all of the officers, directors and employees of the Company. The Board has also adopted Corporate Governance Guidelines, which detail the functions, activities and administration of the Board and its Committees. In addition to the Amended and Restated Charter of the Audit Committee attached to this Proxy Statement as Appendix A, the Board has adopted charters for the Stock Option/Compensation Committee and for the Nominating and Corporate Governance Committee. The Code of Business Conduct and Ethics, Corporate Governance Guidelines and the Committee charters can be accessed on the Company’s website atwww.americredit.com.

Director Independence

The Board of Directors has determined that, with the exception of Messrs. Morris, Berce, Barrington and McCombs, all of its directors, including all of the members of the Audit, Stock Option/Compensation and Nominating and Corporate Governance Committees, are “independent” as defined by the listing standards of the New York Stock Exchange currently in effect and all applicable rules and regulations of the Securities and Exchange Commission. Messrs. Morris, Berce, Barrington and McCombs are not independent because of the following:

No director is deemed independent unless the Board affirmatively determines that the director has no material relationship with the Company, either directly or as an officer, shareholder or partner of an organization that has a relationship with the Company. In making its determination, the Board observes all criteria for independence established by the rules of the SEC and the New York Stock Exchange. In addition, the Board

9

considers all commercial, banking, consulting, legal, accounting, charitable or other business relationships any director may have with the Company.

Procedures for Contacting Directors

Shareholders and other interested parties who wish to communicate with the Board may do so by writing to AmeriCredit Corp., Board of Directors (or Chairman of the Nominating and Corporate Governance Committee, committee name or director’s name, as appropriate), 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102. The non-management directors have established procedures for the handling of communications from shareholders and other interested parties and have directed the Secretary to act as their agent in processing any communications received. All communications that relate to matters that are within the scope of the responsibilities of the Board and its committees are to be forwarded to the Chairman of the Nominating and Corporate Governance Committee. Communications that relate to matters that are within the responsibility of one of the Committees are also to be forwarded to the Chairman of the appropriate committee. Communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities are to be sent to the appropriate officer within the Company for review and investigation as appropriate. Solicitations, junk mail and obviously frivolous or inappropriate communications should not be forwarded, but will be made available to any non-management director who wishes to review them.

Director Nomination Process

In exploring potential candidates for directors, the Nominating and Corporate Governance Committee considers individuals recommended by members of the Nominating and Corporate Governance Committee, other directors, members of management, and shareholders. The Committee is advised of all nominations that are submitted to the Company and determines whether it will further consider the candidates using the criteria described below.

In determining the qualifications for members of the Board of Directors, the Nominating and Corporate Governance Committee will consider the following characteristics, as outlined in the Board’s Corporate Governance Guidelines:

Integrity and Accountability — Character is the primary consideration in nominating and evaluating an AmeriCredit Board member. Directors should demonstrate high ethical standards and integrity in their business and personal dealings, and be willing to act on, and remain accountable for their boardroom decisions.

Informed Judgment — Directors should possess the ability to provide wise and thoughtful counsel on a broad range of issues. Directors should possess a high degree of intelligence, demonstrate prudent judgment and an awareness of the impact of their decisions on shareholders and other stakeholders.

Financial Literacy — Directors should possess the ability to read and understand a balance sheet, income statement and cash flow statement and understand the use of financial ratios and other indices of financial performance.

Mature Confidence — Directors should have the ability to work effectively as part of a team, valuing Board and team performance over individual performance. Openness to other opinions and willingness to listen are as important as the ability to communicate persuasively. Board members should work with each other responsibly, assertively and supportively and raise tough questions in a manner that encourages open discussion. The working relationship between members of the Board and between the Board and management should be characterized by mutual respect.

Innovation — Directors should have the ability to provide counsel to management in developing creative solutions to problems facing the Company and in identifying innovative opportunities that can benefit the Company and its shareholders.

Commitment — Directors should have commitment as demonstrated not only by attendance at Board meetings but by evident preparation and thoughtful participation in Board discussions, willingness to

10

participate in urgent Board discussions on short notice, when applicable, and to be accessible to the Company’s senior management and other Board members, as necessary, outside of Board meetings.

After the Nominating and Corporate Governance Committee has completed its evaluation, it presents its recommendation to the full Board for its consideration and approval. In presenting its recommendation, the Committee also reports on other candidates, if any, who were considered but not selected.

Shareholders may nominate director nominees for consideration by writing to the Secretary of the Company at 801 Cherry Street, Suite 3900, Fort Worth, Texas 76102 and providing the nominee’s name, biographical data and qualifications. In order to be considered by the Nominating and Corporate Governance Committee with respect to nominees for the 2005 Annual Meeting of Shareholders, prospective nominee recommendations must be received by the Secretary no later than September 5, 2005 and no earlier than August 5, 2005.

Compensation Committee Interlocks and Insider Participation

No member of the Stock Option/Compensation Committee is or has been an officer or employee of the Company or any of its subsidiaries or had any relationship requiring disclosure pursuant to Item 404 of Regulation S-K promulgated by the Securities and Exchange Commission ("SEC"(“SEC”). No member of the Stock Option/Compensation Committee served on the compensation committee, or as a director, of another corporation, one of whose directors or executive officers served on the Stock Option/Compensation Committee or whose executive officers served on the Company'sCompany’s Board of Directors.

11

EXECUTIVE COMPENSATION

Summary Compensation Table

The following sets forth information concerning the compensation of the Company’s Chief Executive Officer and each of the other four most highly compensated executive officers of the Company (the “Named Executive Officers”) for the fiscal years shown.

| Annual Compensation | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Fiscal Year | Salary ($) (1) | Bonus ($) | Long Term Compensation Awards Shares of Common Stock Underlying Stock Options (#) | All Other Compensation ($) (2) | ||||||||

| Clifton H. Morris, Jr | 2001 | 380,000 | 525,000 | — | 82,650 | ||||||||

| Executive Chairman | 2000 | 730,000 | 1,050,000 | — | 79,800 | ||||||||

| 1999 | 574,815 | 823,973 | — | 79,750 | |||||||||

| Michael R. Barrington | 2001 | 680,000 | 975,000 | — | 44,770 | ||||||||

| Vice Chairman, CEO & | 2000 | 630,000 | 900,000 | — | 43,819 | ||||||||

| President | 1999 | 474,815 | 673,973 | — | 44,592 | ||||||||

| Daniel E. Berce | 2001 | 655,000 | 937,500 | — | 47,989 | ||||||||

| Vice Chairman & CFO | 2000 | 630,000 | 900,000 | — | 44,566 | ||||||||

| 1999 | 474,815 | 673,973 | — | 44,370 | |||||||||

| Edward H. Esstman | 2001 | 455,000 | 531,250 | — | 48,805 | ||||||||

| Vice Chairman (3) | 2000 | 430,000 | 500,000 | — | 45,955 | ||||||||

| 1999 | 384,061 | 448,202 | — | 45,905 | |||||||||

| Michael T. Miller | 2001 | 386,849 | 453,973 | 150,000 | 8,208 | ||||||||

| Executive Vice President | 2000 | 325,000 | 325,000 | 40,000 | 5,340 | ||||||||

| & COO | 1999 | 255,000 | 255,000 | 18,400 | 5,278 | ||||||||

| Annual Compensation | Long Term Compensation Awards | |||||||||||||

Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Other Annual Compensation ($)(1) | Restricted Stock Award(s) ($)(2) | Shares of Common Stock Underlying Stock Options (#) | All Other Compensation ($)(3) | |||||||

Clifton H. Morris, Jr. | 2004 2003 2002 | 800,000 455,385 380,000 | 1,570,000 — 875,000 | 73,022 82,262 88,472 | — — — | 66,000 190,000 — | 24,604 19,618 82,650 | |||||||

Daniel E. Berce | 2004 2003 2002 | 750,000 730,000 711,301 | 1,471,875 — 1,675,103 | 46,321 79,641 68,217 | — — — | 66,000 190,000 — | 10,689 11,635 47,683 | |||||||

Mark Floyd | 2004 2003 2002 | 400,033 340,897 313,273 | 588,799 — 307,280 | — — — | — — 303,262 | — 100,000 50,400 | 10,791 9,141 8,275 | |||||||

Preston A. Miller | 2004 2003 2002 | 400,033 385,835 360,000 | 588,799 — 450,000 | — — — | — — 303,262 | — 100,000 31,100 | 9,791 8,995 8,151 | |||||||

Chris A. Choate | 2004 2003 2002 | 340,020 300,000 275,000 | 500,467 — 206,250 | — — — | — — 303,262 | — 100,000 31,100 | 10,421 9,791 8,187 | |||||||

| (1) | For fiscal 2004, Includes |

| (2) | The values of the Restricted Stock Awards that are presented in the table are based upon the closing price of $19.53 of the Company’s Common Stock on the NYSE on June 30, 2004. On November 1, 2001, Messrs. Floyd, Miller and Choate were granted 15,528 restricted shares and the value thereof, on the date of grant, was $250,000. These restricted shares vest three years after the date of grant. |

| (3) | The amounts disclosed in this column for fiscal |

| (a) | Company contributions to 401(k) retirement plans |

| (b) | Payment by the Company of premiums for term life insurance on behalf of Mr. |

12

Option Grants in Last Fiscal Year

The following table shows all individual grants of stock options to the Named Executive Officers of the Company during the fiscal year ended June 30, 2001.2004.

| Shares of Common Stock Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year | Exercise Price ($/Sh) | Expiration Date | Grant Date Present Value ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Clifton H. Morris, Jr | — | — | — | — | — | ||||||

| Executive Chairman | |||||||||||

| Michael R. Barrington | — | — | — | — | — | ||||||

| Vice Chairman, CEO & | |||||||||||

| President | |||||||||||

| Daniel E. Berce | — | — | — | — | — | ||||||

| Vice Chairman & CFO | |||||||||||

| Edward H. Esstman | — | — | — | — | — | ||||||

| Vice Chairman | |||||||||||

| Michael T. Miller | 150,000 (1) | 6.70 | 28.44 | 11/7/2010 | 2,118,205 | ||||||

| Executive Vice President | |||||||||||

| & COO | |||||||||||

| Shares of Common Stock Underlying Options Granted (#)(1) | % of Total Options Granted to Employees in Fiscal Year | Exercise Price ($/Sh) | Expiration Date | Grant Date Present Value ($)(2) | |||||||

Clifton H. Morris, Jr. Chairman and Chief Executive Officer | 66,000 | 50 | % | 8.50 | 7/1/13 | 376,860 | |||||

Daniel E. Berce President | 66,000 | 50 | % | 8.50 | 7/1/13 | 376,860 | |||||

Mark Floyd Executive Vice President, Chief Operating Officer | — | — | — | — | — | ||||||

Preston A. Miller Executive Vice President, Chief Financial Officer and Treasurer | — | — | — | — | — | ||||||

Chris A. Choate Executive Vice President, Chief Legal Officer and Secretary | — | — | — | — | — |

| (1) |

| (2) | As suggested by the SEC’s rules on executive compensation disclosure, the Company used the Black-Scholes model of option valuation to determine grant date pre-tax present value. The Company does not advocate or necessarily agree that the Black-Scholes model can properly determine the value of an option. The calculation is based on the expectation that the options are fully exercised within |

13

Aggregated Option Exercises in Last Fiscal Year

and FY-End Option Values

Shown below is information with respect to the Named Executive Officers regarding option exercises during the fiscal year ended June 30, 2001,2004, and the value of unexercised options held as of June 30, 2001.2004.

| Name | Shares Acquired on Exercise (#) | Value Realized ($) (1) | Shares of Common Stock Underlying Unexercised Options at FY-End (#) Exercisable/ Unexercisable | Value of Unexercised In-the-Money Options at ($) (2) FY-End Exercisable/ Unexercisable | |||||

|---|---|---|---|---|---|---|---|---|---|

| Clifton H. Morris, Jr | 1,082,666 | 33,390,403 | 1,452,000/568,000 | 60,407,400/22,691,600 | |||||

| Executive Chairman | |||||||||

| Michael R. Barrington | 450,000 | 13,224,768 | 802,000/568,000 | 32,975,900/22,691,600 | |||||

| Vice Chairman, CEO & | |||||||||

| President | |||||||||

| Daniel E. Berce | 582,214 | 18,660,516 | 968,000/568,000 | 40,271,600/22,691,600 | |||||

| Vice Chairman & CFO | |||||||||

| Edward H. Esstman | 300,000 | 7,867,081 | 594,000/396,000 | 23,730,300/15,820,200 | |||||

| Vice Chairman (3) | |||||||||

| Michael T. Miller | 263,760 | 4,421,040 | 0/385,040 | 0/12,716,328 | |||||

| Executive Vice President | |||||||||

| & COO |

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Shares of Common Stock Underlying Unexercised Options at FY-End (#) Exercisable/ Unexercisable | Value of Unexercised In-the-Money Options at FY-End ($)(1) Exercisable/ Unexercisable | ||||

Clifton H. Morris, Jr. Chairman and Chief Financial Officer | — | — | 1,910,000/66,000 | 16,192,200/727,980 | ||||

Daniel E. Berce President | — | — | 2,010,000/66,000 | 17,345,200/727,980 | ||||

Mark Floyd Executive Vice President, Chief Operating Officer | — | — | 181,240/24,560 | 1,279,829/42,669 | ||||

Preston A. Miller Executive Vice President, Chief Financial Officer and Treasurer | — | — | 282,600/15,000 | 2,174,630/42,669 | ||||

Chris A. Choate Executive Vice President, Chief Legal Officer and Secretary | — | — | 216,200/15,000 | 1,488,881/42,669 |

| (1) |

| Values stated are pre-tax, net of cost and are based upon the closing price of |

14

Additional Information Relating to Employee Benefits

In fiscal year 2004, shareholders approved an amendment to the Company’s Employee Stock Purchase Plan. The following table sets forth certain information relating to employee participation in the Employee Stock Purchase Plan during fiscal 2003 and 2004.

| 2003 | 2004 | |||||||

Name and Position of Individual or Identity of Group | Number of Purchased Shares (#) | Weighted Average Purchase Price ($) | Number of Purchased Shares (#) | Weighted Average Purchase Price ($) | ||||

Clifton H. Morris, Jr., Chairman and Chief Executive Officer | 212 | 6.375 | 5,000 | 6.375 | ||||

Daniel E. Berce, President | — | 6.375 | 4,977 | 6.375 | ||||

Mark Floyd, Executive Vice President, Chief Operating Officer | 608 | 6.375 | 1,872 | 6.375 | ||||

Preston A. Miller, Executive Vice President, Chief Financial Officer and Treasurer | 3,669 | 6.375 | 1,976 | 6.375 | ||||

Chris A. Choate, Executive Vice President, Chief Legal Officer and Secretary | 1,126 | 6.375 | — | 6.375 | ||||

Executive Group (1) | 11,515 | 6.375 | 15,943 | 6.375 | ||||

Non-Executive Director Group, (not eligible to participate) | — | — | — | — | ||||

Non-Executive Officer Employee Group (2) | 502,126 | 6.375 | 554,985 | 6.492 | ||||

| (2) | In fiscal 2003, includes 2,145 persons in the Non-Executive Officer Employee Group. In fiscal 2004, includes 1,749 persons in the Non-Executive Officer Employee Group. |

15

Report of the Stock Option/Compensation Committee on Executive Compensation

During fiscal 2001,2004, the Stock Option/Compensation Committee of the Board of Directors (the "Committee"“Committee”) was comprised of Messrs. Dike, Gerald J. Ford, Greer, Higgins and Jones. The Committee is responsible for all elements of the total compensation program for executive officers and senior management personnel of the Company, including stock option grants and the administration of other incentive programs. In August 2004, prior to the preparation of this report, Mr. Ford resigned from the Company’s Board of Directors and Mr. Dike resigned from the Committee; accordingly, Messrs. Ford and Dike did not participate in the preparation of this report and their signatures do not appear below.

General

The objectives of the Company'sCompany’s compensation strategy isremain as follows: (i) to attract and retain the best possible executive talent, (ii) to motivate its executives to achieve the Company'sCompany’s goals, (iii) to link executive and shareholder interest through compensation plans that provide opportunities for management to become substantial shareholders in the Company and (iv) to provide a compensation package that appropriately recognizes both individual and corporate contributions.

The Committee engaged a nationally recognized compensation consulting firm in June 2004 to perform a compensation analysis for the Company’s top executives. The first portion of this analysis, assessing the competitive position of the Company’s compensation packages for top executives, was concluded in August 2004 and the results of that assessment are discussed in this report.

Components of Compensation of Named Executive Officers.Officers in Fiscal 2004

Compensation paid to the Company'sCompany’s Named Executive Officers in fiscal 20012004 consisted of the following: base salary, and annual bonus. With the exception of Mr. Miller, no stock options or otherbonus and long-term incentive awards were made to the Company's Named Executive Officers in fiscal 2001.awards.

Base Salary

Employment agreements have been entered into between the Company and each of the Named Executive Officers. All of these employment agreements, which are described in greater detail elsewhere in this Proxy Statement, provide for a certain minimum annual base salary with salary increases, bonuses and other incentive awards to be made at the discretion of this Committee.

No base salary increase was made during fiscal 2001 for Mr. Morris.

Effective July 1, 2000, the Committee authorized2003, base salary increases of $50,000 were made for Mr. Barrington, $25,000 foreach of Messrs. Morris and Berce to $800,000 and Esstman and $35,000 for Mr. Miller. In connection with his promotion to co-Chief Operating Officer, Mr. Miller received a $40,000 base salary increase effective October 29, 2000. The$750,000, respectively. These increases for Messrs. Barrington,Morris and Berce Esstman and Miller were considered appropriate by the Committee, in lightpart, due to the fact that the policy of the continuing growthBoard of Directors was changed effective July 1, 2003 to no longer pay Board fees to employee directors. Board fees for Messrs. Morris and financial successBerce were approximately $30,000 in fiscal 2003. Base salary increases were also made in fiscal 2004 for the other Named Executive Officers in the following amounts: $60,533 for Mr. Floyd, to $400,033; $14,533 for Mr. Miller, to $400,033; and $40,020 for Mr. Choate, to $340,020.

The Committee believes, based on the analysis performed by the compensation consultant, that the base salaries of the Company and,Named Executive Officers are generally competitive at the median salary ranges observed at comparable companies, but are somewhat lower (10% to 30% lower) than the 75thpercentile that the Committee has historically used as an objective benchmark. Nonetheless, as of the Record Date, the Committee has not authorized any base salary increases in fiscal 2005 for any of the Named Executive Officers, although such increases may be authorized later in the casefiscal year.

Annual Bonus

In September 2003, the Committee adopted an officer bonus plan for fiscal 2004 that provided bonus opportunities pursuant to a formula based on the Company’s achievement of Mr. Miller, his promotioncertain financial and operating objectives, including, among other targets, earnings, return on assets, originations volume and pricing, and

16

various collection performance targets. Fiscal 2004 was the first year that the Committee had adopted a bonus plan containing a variety of operating targets in addition to co-Chief Operating Officer of the Company.financial or earnings targets.

In light

Under the fiscal 2004 bonus plan, the target bonus opportunity for the CEO and the other Named Executive Officers was between 75% and 100% of his resignation as co-Chief Operating Officer of the Company, Mr. Esstman's base salary and the maximum bonus opportunity was reduced from $425,000 to $225,000 as of August 7, 2001.

Annual Incentive

The purpose of annual incentive bonus awards is to encourage executive officersbetween 150% and key management personnel to exercise their best efforts200%. Based on the Company’s success in achieving superior financial and management skills toward achieving the Company's predetermined objectives. Inoperating performance in fiscal 2001,2004, the CEO and the other Named Executive Officers received annual incentive awards equal to between 100%approximately 147% and 150%196% of their base salary. As described in the Company's 2000 Proxy Statement, these bonus awards were made in return for the Company's successfully meeting earnings per share targets established by the Committee prior to fiscal 2001. Under this plan, minimum earnings levels were required to be obtained before any bonuses were awarded; the plan also defined maximum award levels. Based on the Company's earnings per share in fiscal 2001,salary, or just slightly less than the maximum bonus target was achievedopportunities obtainable of 150% and 200% of base salary.

The Committee has adopted a bonus plan for fiscal 2005 that is structurally similar to the bonus plan adopted for fiscal 2004, in that the 2005 plan contains a formula-based approach that rewards the CEO and the other Named Executive Officers.

ForOfficers for the achievement of both financial and operating performance in excess of certain targets. The Committee has also adopted the AmeriCredit Corp. Senior Executive Bonus Plan, which is proposed for adoption by shareholders and is discussed in detail elsewhere in this Proxy Statement. The bonus plan for fiscal 2002,2005 has been created and adopted by the Committee has approved an incentive plan similarso as to comply Section 162(m) of the Internal Revenue Code of 1986, as amended.

The Committee believes, based on the analysis performed by the compensation consultant, that the target bonus opportunities provided to the planCEO and the Named Executive Officers (between 75% and 100% of base salary) are generally competitive at the market median, but are substantially lower than the 75thpercentile of target bonus opportunities observed at comparable companies. This means that the Company’s total cash compensation (base salary plus targeted bonus opportunity) for its top executive officers is generally competitive at the market median, but is substantially lower (24% to 47% lower) than the 75thpercentile of total cash compensation observed at comparable companies. As noted above, the Committee’s historical objective has been to target total cash compensation at approximately the 75thpercentile of comparable companies, in effect for fiscal 2001, including the establishment of earnings per share targetsorder to retain and award levels associated with the Company's success in meeting those targets.

Long-Term Incentivereward executive management.

In light

Long-Term Incentive Award

The Committee approved stock option grants for 66,000 shares to each of Messrs. Morris and Berce on July 1, 2003 at an exercise price of $8.50, the closing market price on that date. No other option grants were made in fiscal 2004 to any of the other Named Executive Officers. The “Option Grants in Last Fiscal Year” table on page 13 summarizes stock options grantedoption grants in fiscal 2004 to the Named Executive Officers underOfficers.

The Committee has approved certain amendments to the 1998 Limited Stock Option Plan (the "1998 Plan"), approved by shareholders at the 1998 Annual Meeting, no stock option grants were made in fiscal 2001for AmeriCredit Corp. and to the Named Executive Officers, other than Mr. Miller. In connection with his promotion to co-Chief Operating Officer, Mr. Miller was granted a stock option for 150,000 shares on November 7, 2000 at an exercise price of $28.44 per share.

As noted in the 1998 Proxy Statement, there will be no further stock-based, long-term incentive awards to Messrs. Morris, Barrington, BerceAmended and Esstman until the stock options covered by the 1998 Plan are fully vested and exercisable. Furthermore, theRestated 2000 Limited Omnibus and Incentive Plan for AmeriCredit Corp. specifically provides, and these amendments are proposed for adoption by shareholders and are discussed in detail elsewhere in this Proxy Statement.

The Committee’s compensation consultant advised that Messrs. Morris, Barrington, Bercethe Company should be providing long-term incentive awards at least annually to the Company’s CEO and Esstman are not eligiblethe other Named Executive Officers to participateprovide sufficient incentive and retention. The Committee anticipates working further with the compensation consultant in such Plan.fiscal 2005 to determine the most appropriate award types and levels and creating an annual granting plan for the CEO and the Named Executive Officers consistent with the consultant’s analysis.

Other Compensation Plans

The Company maintains certain broad-based employee benefit plans in which executive officers are permitted to participate on the same terms as non-executive personnel who meet applicable eligibility criteria, subject to any legal limitations on the amounts that may be contributed or the benefits that may be payable under the plans.

In addition, the Committee has previously approved a split-dollar life insurance program for Messrs. Morris, Barrington, Berce and Esstman. Under this program, the Company advances annual premiums for life insurance policies on these officers, subject to the right of the Company to recover certain amounts in the event of the officer's death or termination of employment. As adopted by the Committee, the annual premiums will be approximately $75,000 in the case of Mr. Morris and $37,500 in the case of Messrs. Barrington, Berce and Esstman.

Stock Ownership Guidelines for Executive Officers

In August 2000, the Board of Directors adopted stock ownership guidelines that are designed to encourage the accumulation of the Company'sCompany’s stock by its executive officers. TheseIn August 2003, the Committee amended and restated the stock ownership guidelines principally to (i) reflect revisions in executive management participating

17

therein, (ii) extend the transition date by two and a half years as a result of the decline in the Company’s stock price throughout fiscal 2002 and 2003 and (iii) establish a minimum number of shares that must be owned by participants in order to comply with ownership levels, notwithstanding price fluctuations that may occur from time to time in the Company’s stock. The revised guidelines, stated as a multiple of executives'executives’ base salaries and the minimum number of shares that must be owned by executive officers, are as follows: Chairman and Vice Chairmen, four times; Segment Presidents and Treasurer, three times; other Executive Team members, two times.

Position | Base Salary Multiple | Number of Shares To Be Directly Owned | |||

Chairman, Chief Executive Officer and President | 4 | X | 150,000 | ||

Chief Financial Officer, Chief Operating Officer and Chief Legal Officer | 3 | X | 60,000 | ||

Other Executive Team Members | 2 | X | 25,000 |

The recommended time period for reaching the above guidelines is the later of (i) August 1, 2003,December 31, 2005, (ii) five years from date of hire or (iii) three years from date of promotion to an executive officer position. These guidelines are subject to periodic review to ensure that the levels are appropriate. Shares of the Company'sCompany’s stock directly owned by an executive officer and shares owned by an executive officer through the Company's 401kCompany’s 401(k) and employee stock purchase programs constitute qualifying ownership;ownership, and shares of restricted stock owned by an executive officer, whether or not vested, would also qualify. Stock options are not counted towards compliance with the guidelines. The Committee will review the progress of each executive officer toward compliance with the guidelines and, in the event an officer is not making satisfactory progress, the Committee may reduce prospective stock option or restricted share grants to such officer.

As of September 20, 2001, the value

Presently, all of the Company stock owned by each executive officer subjectNamed Executive Officers other than Mr. Floyd own more than the minimum number of shares necessary to comply with the stock ownership guidelines exceededguidelines. Mr. Floyd was promoted to Chief Operating Officer in April 2003 and, accordingly, has until April 2006 to own the required amount, with the exceptionrequisite number of five executive officers, three of whom were newly hired or promoted into executive officer positions within the past two years.shares.

Fiscal 20012004 Compensation of CEO

In the view of the Committee, since reassuming the position of CEO on April 23, 2003, Mr. Morris has demonstrated highly effective leadership and vision in leading the Company’s successful turnaround, while delivering financial and operating performance in fiscal 2004 that exceeded all of the Committee’s expectations. In addition, Mr. Morris has put in place and retained an effective and efficient executive management team that has the intellectual capital and commitment critical to the future success of the Company.

During fiscal 2001,2004, Mr. BarringtonMorris received $650,000$800,000 in base salary, a salarysalary. As noted above, the Committee believes that Mr. Morris’ base salary is in-line with the base salaries paid to the top executive officer at similarly-sized financial services companies andgenerally competitive at the companies previously reviewed bymarket median but is less than the Committee located within the Dallas-Fort Worth area. Mr. Barrington's base salary was established in July 2000 in connection with his promotion to CEO. The salary amount shown for Mr. Barrington in the "Executive Compensation - Summary Compensation Table" on page 8 of this Proxy Statement includes director fees in addition to his base salary.Committee’s 75thpercentile objective.

As discussed above, Mr. Barrington also received athe Committee believes that the cash bonus paid under the 20012004 incentive plan equal to 150%196% of hisMr. Morris’ base salary reflects Mr. Morris’ — and the Company’s — superior performance against financial and operating objectives established at the beginning of fiscal 2004.

Mr. Morris received an option award for 66,000 shares in July 2003 at an exercise price of $8.50. The Committee believes, as confirmed by the compensation consultant, that represented the maximum bonus opportunity for Mr. Barrington. No stock options or other stock-based,annual grants of long-term incentive awards were made to Mr. Barrington during fiscal 2001.are an appropriate component of the CEO’s compensation package.

DOUGLAS K. HIGGINS (CHAIRMAN)

JAMES H. GREER

KENNETH H. JONES, JR.

Notwithstanding anything to the contrary set forth in any of the Company'sCompany’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the preceding report and the Performance Graph on page 1420 shall not be incorporated by reference into any such filings.

18

Certain Agreements

Employment Contracts, Termination of Employment and Change-in Control Arrangements

The Company has entered into employment agreements with all of its Named Executive Officers. These agreements, as amended, contain terms that renew annually for successive five year periods (ten years in the case of Mr. Morris), and the compensation thereunder is determined annually by the Company's Board of Directors,Stock Option/Compensation Committee, subject to the following minimum annual compensation: Mr. Morris, $350,000; Messrs. Barrington andMr. Berce, $345,000; Mr. Esstman, $225,000;Floyd $115,000, Mr. Miller, $145,000; and Mr. Miller, $255,000.Choate $145,000. Included in eachthe agreement for Messrs. Morris and Berce is a covenant of the employee not to compete with the Company during the term of his employment and for a period of three years from the date on which he ceased to be employed as a result of a termination for due cause or voluntary termination unless such voluntary termination occurs within twelve months after a “change in control” (as that term is defined in the employment agreements). Included in the agreement for Messrs. Floyd, Miller and Choate is a covenant of the employee not to compete with the Company during the term of his or her employment and for a period of one year thereafter. The employment agreements alsofor Messrs. Morris and Berce provide that if the employee is terminated by the Company other than for cause, or in the event the employee resigns or is terminated other than for cause within twelve months after a "change“change in control"control” of the Company, (as that term is defined in the employment agreements), the Company will pay to the employee the remainder of his current year'syear’s salary (undiscounted) plus the discounted present value (employing an interest rate of 8%) of two additional years'years’ salary. The employment agreements for Messrs. Floyd, Miller and Choate provide that, in the event of a termination or resignation under the circumstances described in the immediately preceding sentence, the Company will pay to Messrs. Floyd, Miller and Choate, as the case may be, an amount equal to one year’s salary. For all Named Executive Officers other than Messrs.Mr. Morris, and Esstman, "salary"“salary” includes the annual rate of compensation immediately prior to the "change“change in control"control” plus the average annual cash bonus for the immediately preceding three-year period; for Messrs.period. For Mr. Morris, and Esstman, "salary"“salary” includes the highest annual rate of compensation plus the highest annual cash bonus or other incentive payment provided in any of the seven fiscal yearyears preceding the year in which a "change“change of control"control” occurs.

In addition to the employment agreements described above, the terms of all stock options granted to the Named Executive Officers provide that such options will become immediately vested and exercisable upon the occurrence of a change in control as defined in the stock option agreements evidencing such grants.

The provisions and terms contained in these employment and option agreements could have the effect of increasing the cost of a change in control of the Company and therebypossibly delay or hinder such a change in control.

19

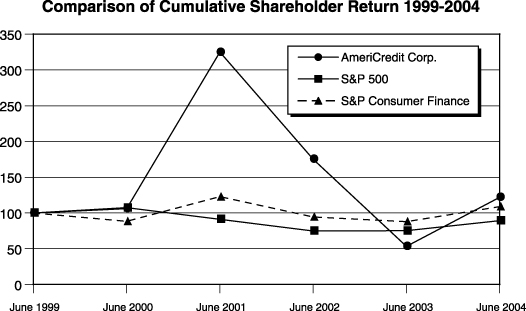

Performance Graph

The following graph presentsperformance graphs present cumulative shareholder returnreturns on the Company'sCompany’s Common Stock for the five years ended June 30, 2001. The2004. In the five-year performance graph, the Company is compared to (i) the S&P500&P 500 and (ii) the S&P Consumer Finance Index. S&P recently split the S&P Financial Index into the S&P Consumer Finance Index and the S&PFinancial&P Diversified Financial Services Index. Each Index assumes $100 invested at the beginning of the measurement period and is calculated assuming quarterly reinvestment of dividends and quarterly weighting by market capitalization.

The data source for the graph is Media General Financial Services, Inc., an authorized licensee of S&P.

| June 1999 | June 2000 | June 2001 | June 2002 | June 2003 | June 2004 | |||||||||||||

AmeriCredit Corp | $ | 100.00 | $ | 106.25 | $ | 324.69 | $ | 175.31 | $ | 53.44 | $ | 122.06 | ||||||

S&P 500 | $ | 100.00 | $ | 107.25 | $ | 91.34 | $ | 74.91 | $ | 75.10 | $ | 89.45 | ||||||

S&P Consumer Finance | $ | 100.00 | $ | 88.27 | $ | 122.64 | $ | 94.49 | $ | 87.81 | $ | 108.79 | ||||||

20

Comparison of Cumulative Shareholder Return1996-2001

June 1996 June 1997 June 1998 June 1999 June 2000 June 2001 AmeriCredit Corp. $100.00 $134.40 $228.40 $204.80 $217.60 $664.96 S&P 500 $100.00 $134.70 $175.33 $215.22 $230.83 $196.59 S&P Financials $100.00 $152.01 $211.22 $228.70 $209.68 $258.97

The Company'sCompany’s executive officers and directors are required to file under the Securities Exchange Act of 1934, as amended, reports of ownership and changes of ownership with the SEC. Based solely upon information provided to the Company by individual directors and executive officers, the Company believes that during the fiscal year ended June 30, 2001,2004, all filing requirements applicable to its executive officers and directors were met.met except as follows: (i) a purchase by Mr. Jones of 1,000 shares in a private transaction on August 29, 2003 was not reported until September 10, 2003, (ii) a disposition by Mr. Steven P. Bowman, the Company’s Executive Vice President and Chief Credit Officer, of 1,454 shares effective May 1, 2004, was not reported until May 20, 2004 and (iii) a sale by Mr. Dike and his wife of 12,000 shares on June 25, 2004 was not reported until July 14, 2004.

Related Party Transactions

The Company engagespreviously engaged independent contractors to solicit business from motor vehicle dealers in certain geographic locations. During fiscal 2001, oneOne such independent contractor was CHM Company, L.L.C. ("(“CHM Company"Company”), a Delaware limited liability company, that is controlled by Clifton H. Morris, III, an adult son of Mr. Clifton H. Morris, Jr., Chairman and Chief Executive ChairmanOfficer of the Company. A per contract commission iswas paid to CHM Company for each motor vehicle contract originated by the Company that is attributable to the marketing efforts of CHM Company. Commission payments of $1,813,941 were made by the Company to CHM Company during fiscal 2001. Out of payments received from the Company, CHM Company pays all of its expenses, including salaries and benefits for its employees and marketing representatives, office expenses, travel expenses and promotional costs. The Company'sCompany’s contractual arrangement with CHM Company has beenwas cancelled effective December 31, 2000. Although the contract has been cancelled, CHM Company is entitled to continue receiving monthly payments per the original contract terms with respect to motor vehicle contracts originated by CHM Company prior to contract termination that meet certain portfolio performance criteria.criteria, namely that payments are continuing to be made by consumers to the Company on such contracts. The Company made payments of $98,093 to CHM Company during fiscal 2004.

On September 21, 2000, Messrs. Barrington

The Company selects independent contractors on a competitive bid basis from a group of qualified vehicle recovery and Berce,repossession agencies with whom it maintains ongoing relationships. During fiscal 2004, the Company engaged Texas Expeditors of Dallas/Fort Worth, LP (“Expeditors of DFW”), a Texas limited partnership, Texas Expeditors of San Antonio, LP (“Expeditors of San Antonio”), a Texas limited partnership, Texas Expeditors of Houston, LP (“Expeditors of Houston”), a Texas limited partnership, as three of its vehicle recovery agencies. These recovery agencies are controlled by Clifton H. Morris, III, an adult son of Mr. Clifton H. Morris, Jr., Chairman and Chief Executive Officer of the Company. A per vehicle payment is made pursuant to a fee schedule submitted by Expeditors of DFW, Expeditors of San Antonio and Expeditors of Houston for each recovery, repossession or other service performed. The Company considers the fees charged by these companies to be competitive and reasonable. During fiscal 2004, payments of $561,634, $258,525 and $738,955 were made by the Company to Expeditors of DFW, Expeditors of San Antonio and Expeditors of Houston, respectively. The aggregate amount of payments the Company paid in fiscal 2004 to the three vehicle recovery companies controlled by Clifton H. Morris, III represented approximately 3% of the total recovery and repossession fees paid by the Company to all vehicle recovery agencies in fiscal 2004.

In fiscal 2004, the Company purchased retail installment contracts originated by automobile dealerships in which Mr. McCombs’ immediate family members are executive officers in an amount that did not exceed 1% of the total retail installment contracts purchased by the Company each executed Amendedin fiscal 2004.

Mr. Barrington stepped down as Chief Executive Officer and Restated Revolving Credit NotesPresident in April 2003. The Company entered into a separation agreement with Mr. Barrington pursuant to which Mr. Barrington received a separation payment, calculated pursuant to his employment agreement, and a consulting fee in the amount of $1,000,000$125,000 per year in favorexchange for his agreement to provide certain services for up 360 hours per year over a 24 month period beginning May 1, 2003. Under the separation agreement, Mr. Barrington also agreed to a two-year non-compete and non-solicitation agreement and provided a release of all claims against the Company and related entities and parties. The Company also agreed to reimburse Mr. Barrington for all reasonable out-of-pocket expenses incurred by him in the performance of his consulting services. The Company and Mr. Barrington are presently negotiating to amend the separation agreement to extend the term of the Company. These Notes, which modifyconsulting arrangement from April 30, 2005 to April 30, 2006. On August 31, 2004, Mr. Barrington announced his intention not to stand for re-election to the Board of Directors.

21

PROPOSAL TO AMEND THE 1998 LIMITED STOCK OPTION PLAN FOR

AMERICREDIT CORP.

(Item 2)

The 1998 Limited Stock Option Plan for AmeriCredit Corp. (the “1998 Plan”) was approved in November 1998 by the Company’s shareholders and extend notesprovided for stock option grants to the Company’s top five executive officers at the time, including Messrs. Morris and Berce. The options granted under the 1998 Plan vested and became exercisable in four equal increments based on the Company’s achievement of earnings per share targets in fiscal years 1999 through 2002. Messrs. Morris and Berce, each of whom were granted options for 1,136,000 shares under the 1998 Plan, have not exercised any of their options and each presently holds all options originally granted to them under the 1998 Plan. The options have an exercise price of $12.00 per share. The options granted under the 1998 Plan are presently set to expire on January 26, 2005.

All other options granted to the other executive officers participating in the principal amount1998 Plan have been exercised and are no longer outstanding. All descriptions of $1,000,000 executedthe terms and amounts under the 1998 Plan are adjusted to reflect the Company’s 2-for-1 stock split that occurred in October 1998.

The Stock Option/Compensation Committee has approved Amendment No. 2 to the 1998 Plan that would effectively extend the expiration date for the options granted to Messrs. Morris and Berce under the 1998 Plan from January 26, 2005 to January 26, 2007, i.e., a two-year extension. Amendment No. 2 would also “un-vest” the options held by Messrs. BarringtonMorris and Berce under the Plan, and require that the Company achieve a 1.8% or better return on managed assets for fiscal 2005 for the options to become “re-vested.” If this return on managed assets is not achieved in September 1999, bear interestfiscal 2005, then the options will not become re-vested and the options will be effectively forfeited by Messrs. Morris and Berce. These amendments (collectively referred to as the “amendments” in this section of the Proxy Statement), which are described in greater detail below, are subject to shareholder approval and will not become effective unless such approval is obtained.

Reasons for the Amendments

The Stock Option/Compensation Committee approved these amendments to the 1998 Plan for the following reasons:

22

Description of the Amendments